Texas Business Law

Our goal is to help you structure your business affairs in a manner that minimizes your risks and affords you with the most protection available under the law. We also recognize that sometimes, disputes are inevitable. It is important to have legal representation there for you when controversy arises. We will research the problem, create an individualized plan of action that explains all of your options and see you through to a resolution.

If you need a San Antonio, TX, commercial attorney to represent your company in a business transaction, then hire San Antonio Business Lawyers. We have seen businesses and corporations through mergers, litigation, and contract drafting sessions in San Antonio, TX. When you work with our firm, you are sure to make the most legally sound business decisions for your shareholders and your employees.

If you are entering into a binding agreement with another business, you may want to have someone advise you on how best to proceed. We have been helping San Antonio companies make ethical and transparent decisions for more than 20 years now. We enjoy helping local business owners and entrepreneurs. This allows us to invest our talents in the success of the local economy. Plus, your trusted legal advisor is always just a short drive or a phone call away when you work with a firm in your area.

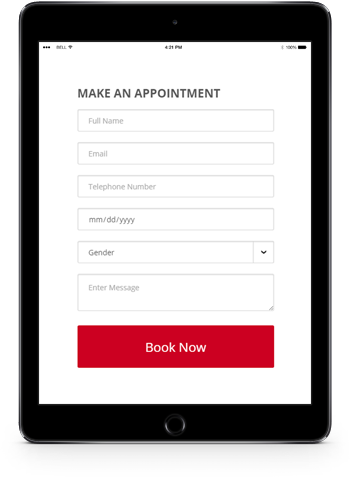

Schedule a consultation with a San Antonio, TX, commercial attorney from San Antonio Business Lawyers when you need legal advice for your business. We look forward to protecting your holdings and helping you make the best choices for your growing San Antonio, TX, venture. Call our office today. We are ready to arrange for a meeting whenever you can find the time. Don’t wait too long. Your assets may be vulnerable.

Latest News

Calculating breakeven sales is a critical business skill

With capital as tight as it is and revenues for many companies down, calculating your company’s breakeven sales is a skill that can help you better plan and manage your fixed and variable costs. Small business owners who are struggling with profitability should calculate their breakeven sales so they have…

The Impact of a Divorce on a Texas Business

A Texas divorce is a difficult and painful process and can be especially stressful and complicated for a business owner. Many issues arise whether one or both spouses are owners of the business. Plan Ahead There are some steps you can take to protect your business, but these need to…

Estimated Tax Payments… Who Are They Good For?

The great Yogi Berra has a famous saying: “It’s like déjà vu all over again.” On April 15th (Tuesday April 18th in 2017) the IRS is going to want the money that taxpayers owe them for 2016 taxes. In addition, they would like taxpayers to send their first installment of…

4 Ways Commercial Advanced Term Loans Help Businesses

Banks offer a number of financial products that help smart business owners get ahead. Businesses only know to take advantage of those products once they learn what they are and how they work. An advancing term loan could be the answer to a problem your business faces. Here’s what you…

Buying a Texas Business

Purchasing a business is a complex process and every transaction is different. The two most important things a Buyer can do to minimize issues after buying a business are to perform adequate due diligence before becoming obligated to purchase the business and to document the transaction with properly drafted legal…

Texas Franchise Tax

Taxable entities organized in Texas or doing business in Texas are subject to a franchise tax or business tax. Even if your business does not owe taxes, it is required to file a Franchise Tax Report each year. You will be required to show that your business franchise taxes are…